Preparing your hurricane kit is about to become a bit easier. A new tax law permanently exempting certain hurricane kit items from state sales tax, goes into effect on Aug. 1.

Florida House Bill 7031, which was signed by Governor DeSantis on June 30, designates items that will not longer subject to sales tax. The list includes essentials like batteries (AA, AAA, C, D, 6-volt, and 9 volt), carbon monoxide detectors, portable generators, tarps, and portable gas cans. Non-perishable food items, bottled water, and common hygiene and personal health items that are common additions to disaster readiness kits are already categorized as nontaxable by the Florida Department of Revenue.

In years past, the state held two 14-day sales-tax holidays for disaster preparedness items. The first holiday was typically held toward the beginning of June, coinciding with the beginning of the Atlantic hurricane season. The second was held during the end of August or beginning of September, coinciding with the peak of hurricane season.

The permanent elimination of sales tax on preparedness items allows Floridians to save money year-round, and to remain prepared for disasters year-round. In a press release, Senate President Ben Albritton said, “We know severe weather can strike at any time. Year-round, permanent savings on key disaster preparedness items help families and seniors get and stay prepared, fostering safer homes and communities across the state.”

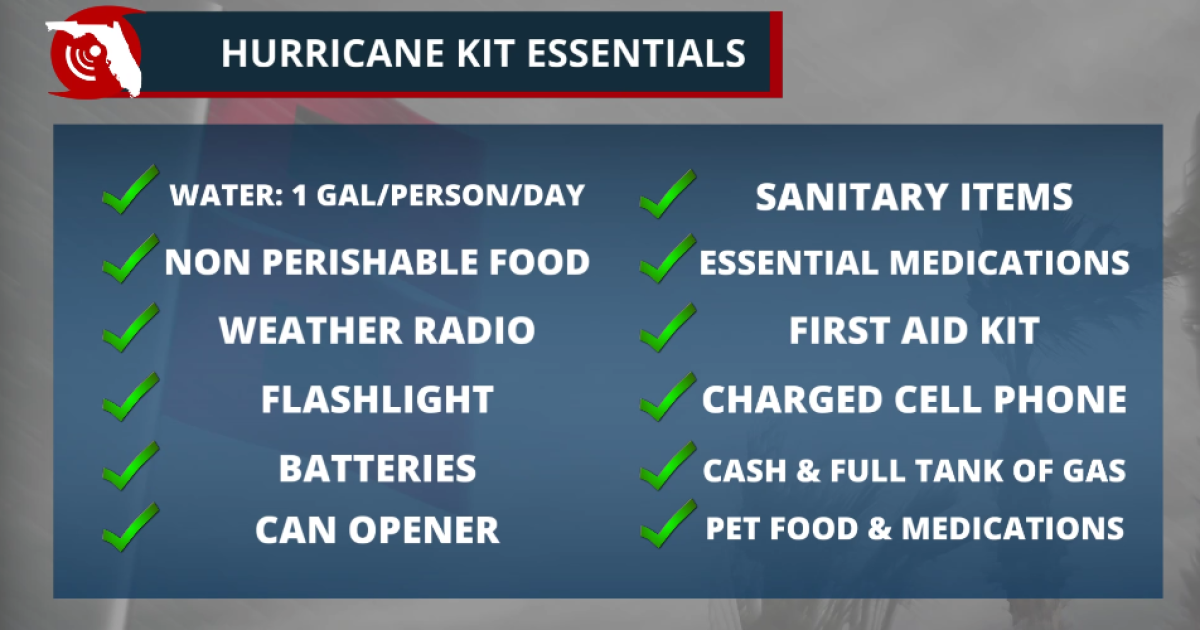

If you need to restock or create a hurricane supply kit for your household, consider the adding the following items:

In addition to these purchased items, assemble waterproof clothing and shoes in your kit. Keep copies of important documents in a waterproof container. This includes home deeds, banking information, vehicle information, insurance policy information, birth certificates/social security cards and pet documentation.

A more exhaustive disaster supply checklist can be found on the Florida Division of Emergency Management website.

A full list of the new sales-tax exemptions, and a list of grocery and personal health items exempt from sales tax can be found on the Florida Department of Revenue’s website.